Can Cryptocurrency Survive Recession – cryptokinews.com

Bitcoin, the largest cryptocurrency in the world, was created in 2009 during the depths of the great financial crisis. It took a while to gain traction, but it, along with other cryptocurrencies, has since exploded into a major market worth around $1 trillion.

But with the broad crypto market falling sharply from all-time highs reached in November 2021 as the Federal Reserve raises interest rates to combat high inflation, many investors are wondering how Bitcoin and other crypto assets might fare if the economy slides into a recession.

Here’s what crypto investors should expect, per the experts.

The Growth of Cryptocurrency

Analysis: Over the past few years, cryptocurrencies have exploded in popularity and value.

Last year, the cryptocurrency market grew to more than $3 trillion in value — more than quadruple what it was worth in 2020 — Time Magazine reported.

These assets, which got their start when Bitcoin made its debut in 2009, seek to create a financial system free of the oversight of governments and big banks.

In the wake of the financial crisis, early crypto-users fantasized of an economy free of the politicians and financiers whose actions led to the 2008 financial crisis. As Wired reported back in 2011, it’s not a coincidence that Bitcoin’s mysterious founder Nakamoto released his paper outlining how his currency would work in 2008 just as the U.S. government was bailing out big banks and automakers.

Instead of a third-party maintaining its ledger, Bitcoin uses a collective network of cryptocurrency miners to keep track of its transactions and create new coins. Since transactions are recorded on databases on many different computers, users can keep track of one another and make sure no one is tampering with the system.

“Bitcoin and cryptocurrency were created by Satoshi Nakamoto exactly when the economic crisis of 2008 kicked in,” said Alex Lemberg, CEO of the Nimbus Platform, a blockchain-based company that specializes in decentralized finance solutions.

Now, the Motley Fool reports there are more than 12,000 cryptocurrencies. The real-time blockchain ledgers that record transactions and keep track of how much cryptocurrency is out there, are being used to track everything from vaccine temperatures and outbreaks of foodborne illnesses to tracking supply chains and documenting the sale of digital art through non-fungible tokens (NFTs).

In 2018, a group of software developers and entrepreneurs coined the term decentralized finance (DeFi) to describe financial services that are automatically executed on blockchains.

Decentralized exchanges and lending systems allow people with digital wallets to trade assets, invest in a Roth IRA, take out loans or take out insurance policies, oftentimes using cryptocurrencies. These exchanges are often executed on smart-contracts, which are programs set to execute an agreement automatically if certain conditions are met.

“Decentralized financial applications are the same as regular mobile applications with one addition — its back-end code is run on blockchain, thus creating working scenarios for smart-contracts,” Lemberg said. “This way a decentralized financial application eliminates a central intermediary, whose functions were automated.”

A correction in 2022

After excessive stimulus and liquidity, the Fed (Federal Reserve) aims to raise rates three times in 2022. Financial markets tend to be less risky when the Fed increases interest rates. Investing in crypto is risky. As a new rate-hiking cycle begins, investors may be less interested in cryptos.

Inflation will drop sharply in 2022, according to the bond market. Despite three Fed rate rises next year, the 10-year Treasury yield is below 1.4%. If inflation cools next year, fewer investors will seek inflation hedges, which might hurt crypto prices.

And near-term trend lines are negative. Bitcoin prices fell below their 50-, 100-, and 200-day moving averages for the first time since May 2021. Technical assistance looks to cost $42,000. A move toward that level seems plausible.

Overall, we’re near-term crypto bearish. The crypto markets may suffer in the following months.

Long-term bulls like this. Weakness now is an opportunity later. We think strong adoption patterns, altering regulation, better technology, and solid investment will propel the crypto markets in the next 12 months, three years, and ten years.

Long-term bulls like this. Weakness now is an opportunity later. We think strong adoption patterns, altering regulation, better technology, and solid investment will propel the crypto markets in the next 12 months, three years, and ten years.

A Recession Won’t Kill Cryptocurrency

Two consecutive quarters of decreasing GDP define a recession, say most economists. According to this definition, the U.S. hasn’t had a recession since the “Great Recession” from December 2007 to June 2009. Due to inflation, the conflict in Ukraine, and Coronavirus supply chain concerns, the economy is under stress. Stress is probably the last barrier.

Satoshi Nakamoto designed Bitcoin after the “Great Recession” Cryptocurrency hasn’t seen a recession. Satoshi invented Bitcoin to reduce our dependency on banks (including central banks), whose irresponsible lending practices caused the property market meltdown. National Council for the Social Studies published a fantastic description of the housing market crash. Investors ignored fundamentals to seek short-term profits, the Federal Reserve adjusted interest rate policy, and the market had excessive leverage. Can cryptocurrencies survive a recession?

Bear case

Many believe cryptocurrency’s $1 trillion industry is here to stay. “Too big to fail” has been debunked several times. Given that cryptocurrency is unregulated primarily and many government officials disapprove of it, it’s unlikely to get governmental help in the event of a significant crash. Terra Luna’s fall in less than a week exposes the cryptocurrency market’s weakness.

Leverage might also cause cryptocurrencies to crash. Leverage is using debt to boost investment returns (or losses). Bitcoin leverage hit a record high in January, according to Cointelegraph. Many exchanges have 10x, 20x, and 100x leverage. Investors will liquidate their holdings if prices drop significantly, sparking a big sell-off. This might generate a ‘death spiral’ of selling. Many have compared the usage of leverage in crypto markets to improper lending practices that led to the housing market crash.

Crypto markets can’t control outside economic influences. The Federal recently boosted interest rates to assist the economy and manage inflation. The Federal Reserve balances inflation and economic growth. Lower interest rates mean more cash in the economy but increase inflation. Higher interest rates boost company and consumer borrowing costs, lowering consumption. Rate rises might trigger a recession. In a recession, people may need to sell their crypto assets to pay for food and housing.

Bull Case

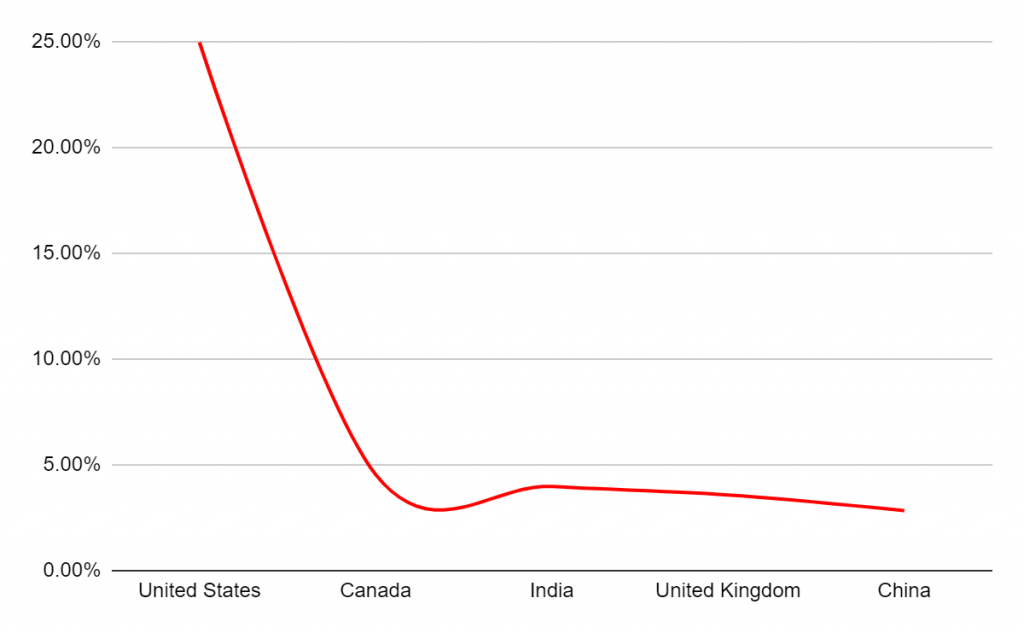

Crypto should withstand a recession despite the bear case’s fears. This article focuses on the U.S. economy, yet Bitcoin is a worldwide asset. Chainalysis published The 2021 Geography of Cryptocurrency Report, which details cryptocurrency adoption by nation, region, platform, etc. Bitcoin is El Salvador’s currency. This worldwide popularity means that if one country’s economy crashes, cryptocurrencies will have a use case in another.

The economy hasn’t halted blockchain’s growth. The economy’s cycle goes quicker than start-up investment. A venture capital fund invests in early initiatives, which need time to develop and launch. Then, the project’s total worth is established. According to The Economic Times, $10 billion was invested in crypto markets in the first quarter of 2022. Despite the economic slump, projects are still being developed. As long as the money flows, we’ll see new ventures. Despite more regulation and an unpredictable economy, VCs continue to invest in cryptocurrencies.

Cryptocurrency’s potential is key to surviving a recession. Crypto isn’t simply for peer-to-peer payments anymore. DeFi, NFTs as art, gaming, and Polygon Nightfall are current use cases for cryptocurrencies. Many additional use cases have been proposed but not widely adopted. Cryptocurrency has enormous potential as housing deeds, digital identities, and decentralized storage. The bitcoin market has entered numerous businesses, reducing the possibility of a collapse.

This dip looks good

But we’ll purchase this dip cautiously. Cryptos are the future, but the market is packed with bad investments.

A recent analysis by Chainalysis indicated that investment frauds using digital currencies, in which cryptocurrency producers construct a fake project, earn money through coin sales, and then dump all their tokens on uninformed retail investors, will be $2.8 billion industry in 2021.

And “pup coins” are worse. It claims to have been worth few do. Many fail.

90% of cryptos will fail, I’d estimate. It’s common in developing tech marketplaces. Dot-com bubble of 1999-2000. Dozens of online firms died.